Capital Equipment Manufacturer Uses Procurement Improvement Process to Leverage Growth and Reduce Costs 5%

The Situation

A Private Equity owned manufacturer of capital equipment was experiencing significant growth from both acquisitions and organic growth. Our client is viewed as the premier supplier of this type of capital equipment in an industry with many entrants. Barriers of entry to this business are not significant so cost and service are viewed as critical to achieving and maintaining market share. Generally, incumbents enjoy repeat business from existing customers. The acquisitions (from a procurement perspective) were not integrated into the enterprises processes and volume synergies were not being explored. As a result anticipated cost reductions were not being achieved.

Our client was looking to leverage the total enterprise spend, increase the professionalism of the procurement group and realize the synergies that have been presented due to acquisitions.

ARGO-EFESO’s Solution and Implementation

The initial step was to execute a four-week deep dive analysis to identify the opportunity and develop an implementation plan.

Procurement Solutions

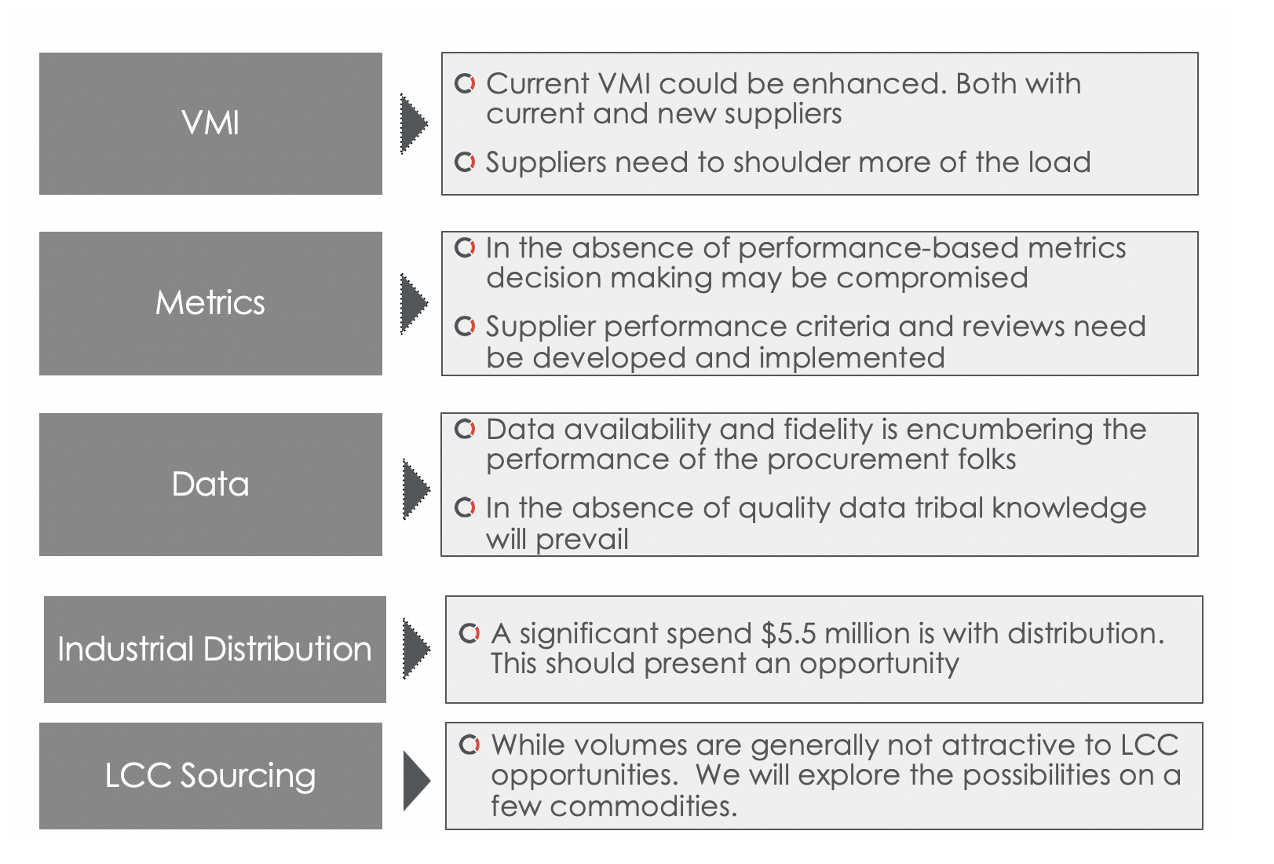

Key Findings

Spend Consolidation and Supplier Rationalization While many of the “commodities” being purchased were common between multiple facilities the number of common suppliers being used to service multiple facilities was very low.

Procurement not Viewed as Strategic Most of the procurement activity was viewed as tactical and not strategic. Most of the purchasing activity was performed as individual purchase orders and volumes (both local and enterprise) were not being leveraged.

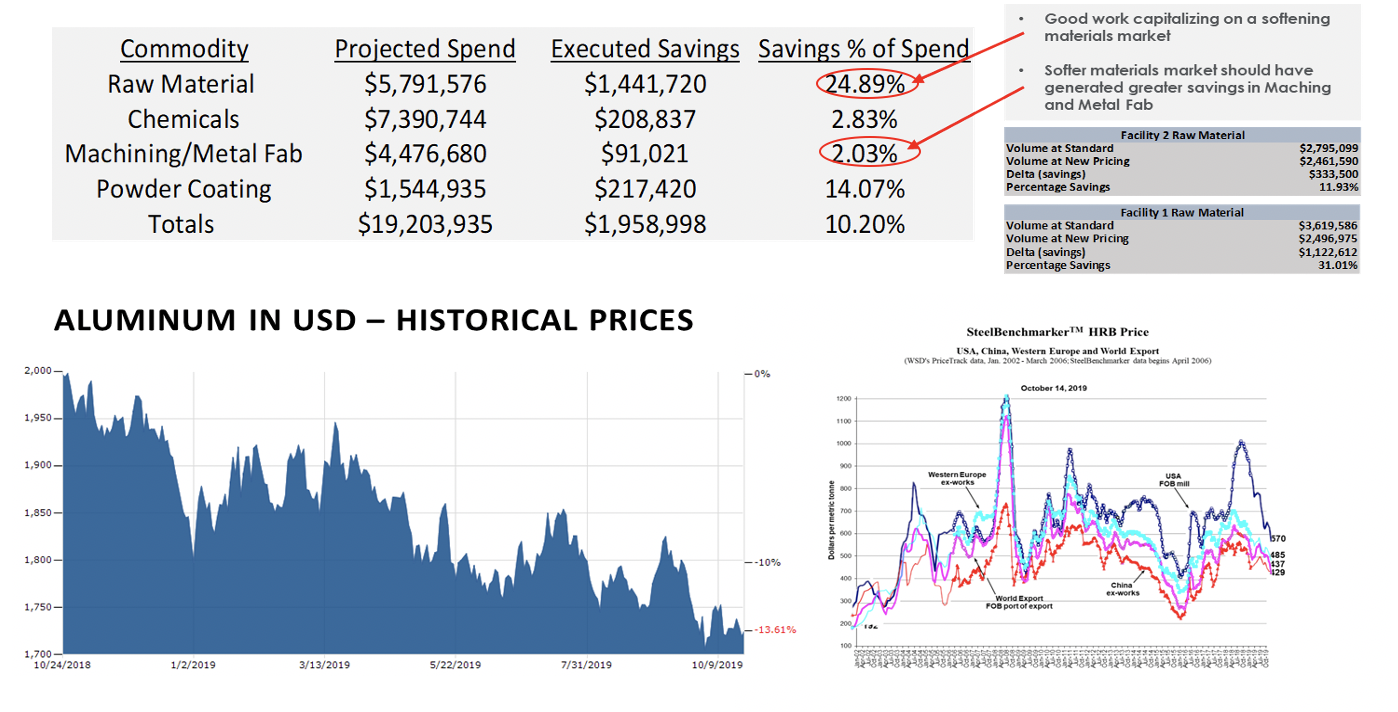

Softening Commodity Pricing The client was able to recognize softening commodity pricing and was able to achieve some significant cost reductions. However the same strategy needed to be employed to all purchased components that that have the softening commodity prices as part of their cost structure.

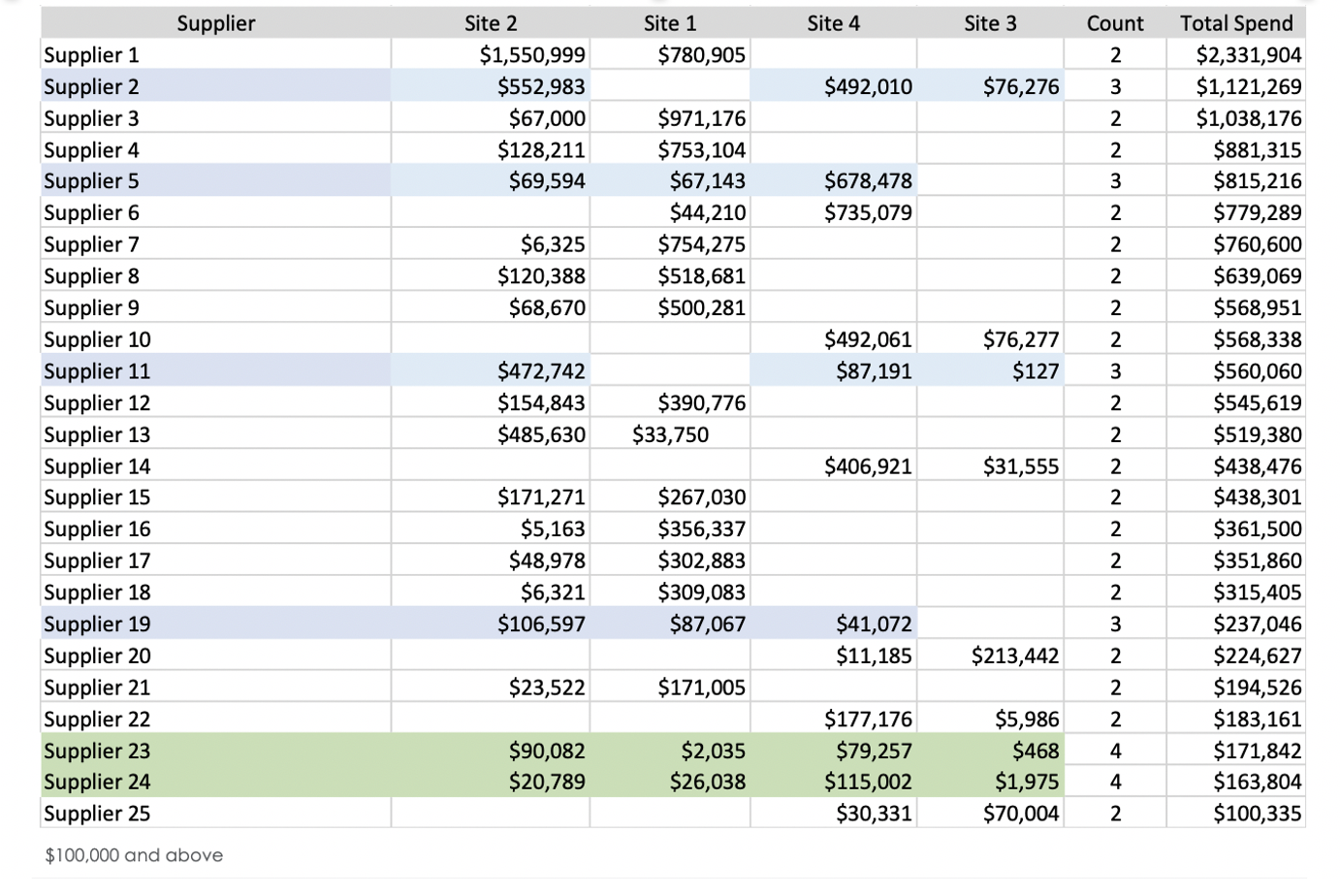

Enterprise Coordination among the procurement leads at the facilities need to be enhanced. Strategies need to be discussed and agreed upon. Spend consolidation needs to be implemented and executed. Commodity management methodology needs to be implemented.

Contractual Language Current contract language needs to be strengthened. Cost reduction language needs to be incorporated as well as performance improvement and most favored nation language.

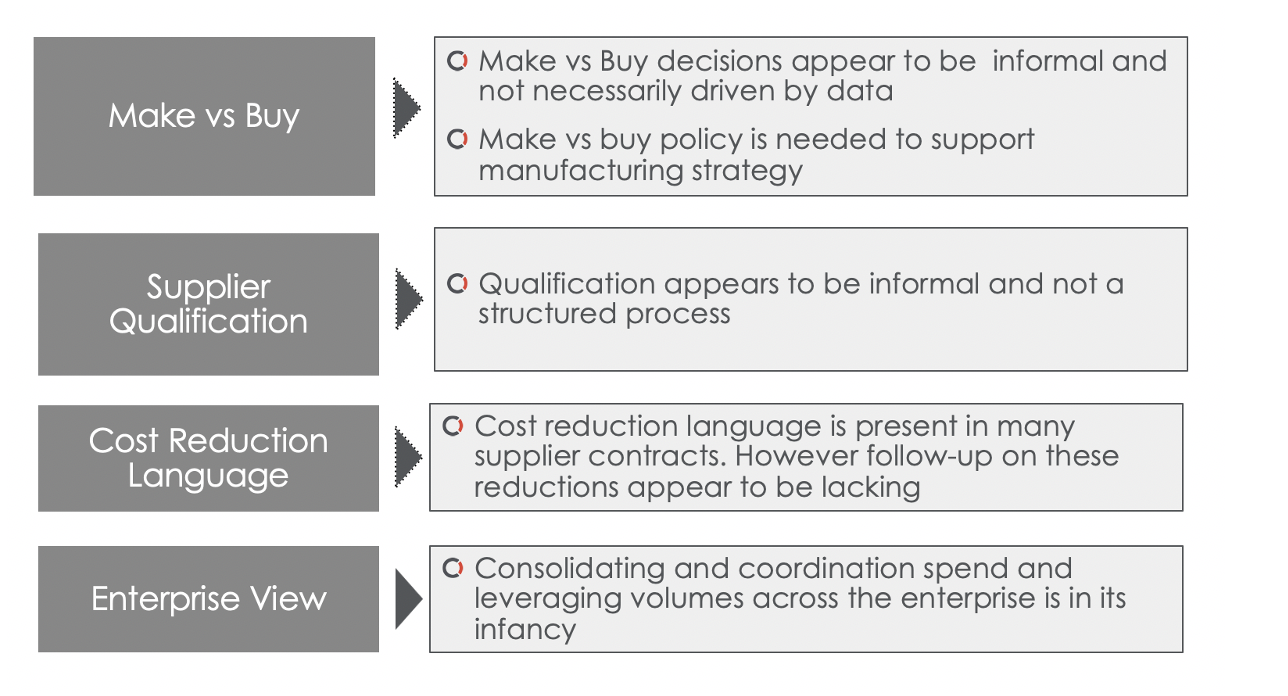

Common Supplier Spend

Limited coordinated spend across the enterprise, with:

- Two suppliers serving all four facilities

- Four suppliers serving three of four facilities

- Twenty-one suppliers serving more than one facility

Commodity Spend

Procurement Cost Savings Opportunities

Commodity savings need to be leveraged to the component level

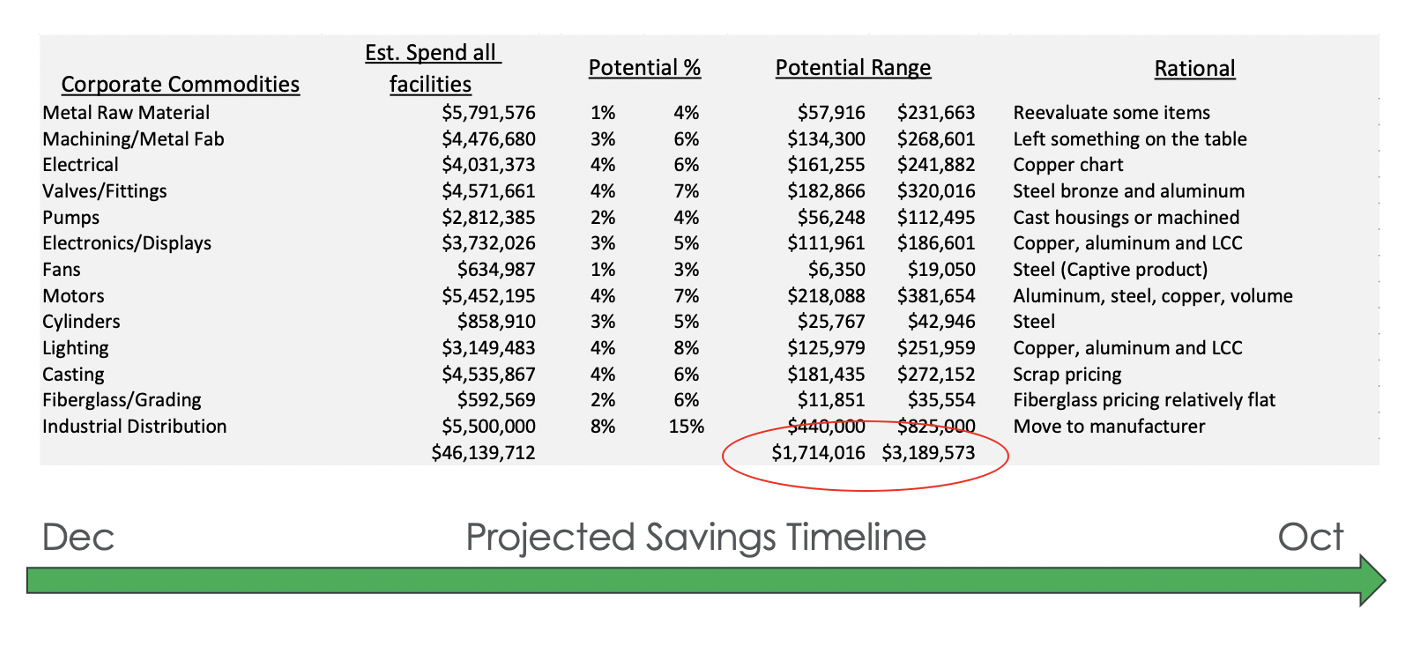

Projected Saving Potential

With an increase in bandwidth, concentrated effort, project management, and professional guidance, we found the following potential cost savings:

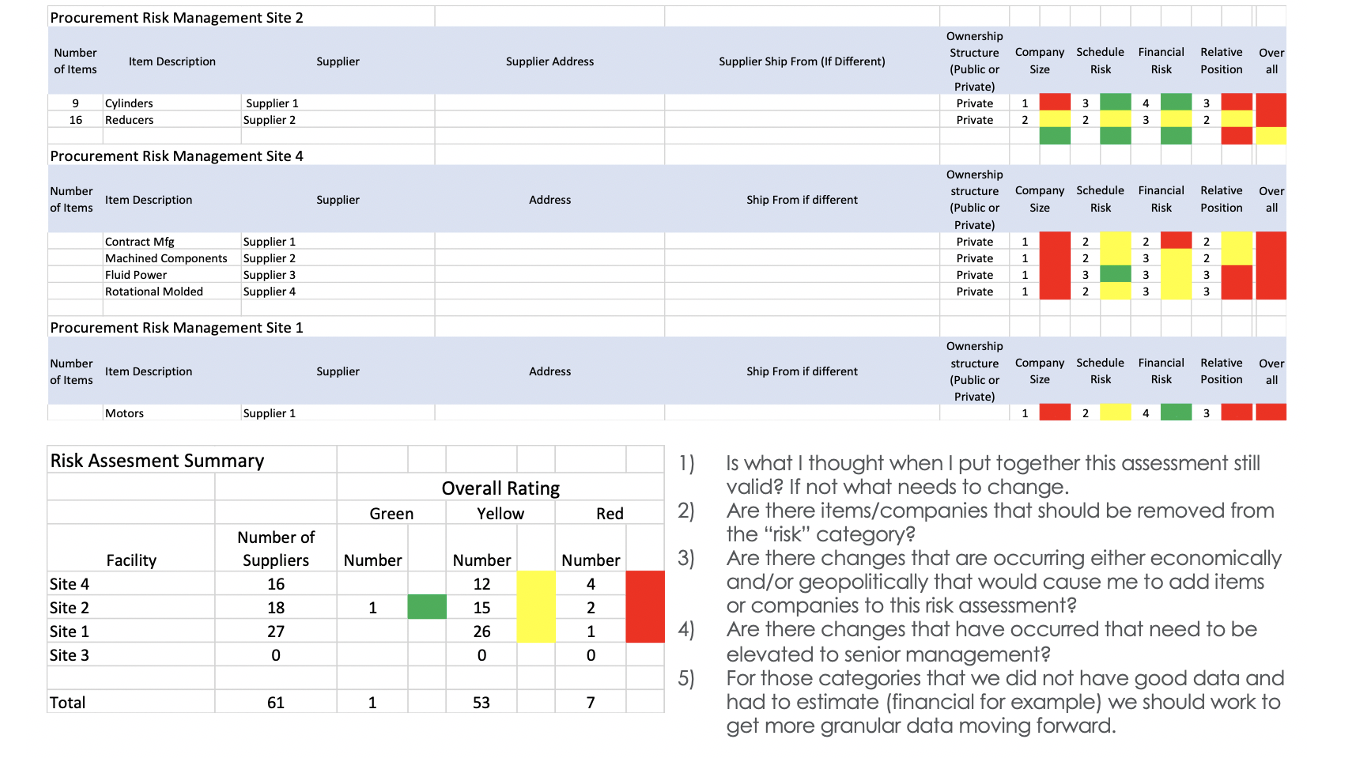

During the implementation, the COVID-19 pandemic caused global supply chain disruptions. ARGO-EFESO orchestrated and implemented a risk mitigation assessment to determine and predict where disruptions may or could occur. Once the assessment was completed risk mitigation plans were developed and implemented.

Risk Assessment Summary

ARGO-EFESO filled an interim procurement lead position at the client and implemented a process that aligned all the procurement leads and developed a sourcing plan that assigned individual leads specific commodities and responsibilities. ARGO-EFESO also aligned strategic and tactical procurement functions and developed roles and responsibilities for each function. We then developed a strategy for each commodity and an implementation plan. Then developed metrics to track progress.

Summary

ARGO-EFESO was able to exceed (on the high side) savings target greater than 5% of material spend of our original assessment of the savings opportunity. We were able to do this by deploying various procurement strategies. The managed competition strategy for raw materials was the most successful and produced the largest savings. The split manufacturing strategy (essentially a make vs buy) also provided significant savings. Supplier changes and negotiations also provided additional savings. In addition, the client was left with a process that can be used to generate additional cost reductions going forward.

About the Authors:

David Bilby is a co-leader on ARGO-EFESO Private Equity practice. Prior to joining ARGO-EFESO, he was a Senior Director at Alvarez & Marsal. [email protected]

Fernando Assens is ARGO-EFESO’s Managing Partner and a co-leader of its Private Equity Practice. He focuses in Industrial and Distribution companies. [email protected]

Brick Logan is Vice President of Procurement at ARGO-EFESO. He has more than thirty years experience in manufacturing, operations, supply chain and procurement. [email protected]