Reconfiguring Value Chains, Networks, and Facilities to Rapidly Increase Returns on Capital

The Problem:

A volatile, uncertain, complex, and ambiguous (VUCA) business landscape — including changing regulations, tariffs, and global economics — challenges private equity (PE) firms as they seek to get maximum returns from their portfolio of assets.

The Solution:

In response to business challenges, many PE firms are trying to optimize their portfolio companies’ networks of plants, assets, and suppliers to increase value and returns. Few PE firms can do this alone, and they’re turning to the EFESO Asset Portfolio Optimization approach, which has rapidly reconfigured sourcing and production networks, decreased network costs, and increased profits from the same or fewer assets and investments via:

- Value-Chain Optimization considers the holistic value-chain and identifies the means to establish an agile, resilient, and more efficient value chain.

- Network Footprint Optimization evaluates the location of assets and establishes a new network that produces in the best locations in response to current and future demand and facilities’ capabilities and capacity.

- Node Optimization identifies wastes and weaknesses of plants and closes those gaps through the application of lean techniques to improve quality, cost, and delivery.

EFESO subject matter experts bring deep industry and operations experience to clients as we not only assess and set strategy for reconfigured assets, we are on the ground with PortCo (Portfolio Company) management to execute on those plans. In as little as six months, we’ve delivered sustainable result to PE firms, including 5-9% revenue increase, 6-10% EBIT increase, 20% to 30% reduced capital spend.

As private equity (PE) firms manage multisite portfolio companies toward three- to five-year sales horizons, both the holding companies and their PortCos are confronting a volatile, uncertain, complex, and ambiguous (VUCA) business landscape that challenges them as they seek to get maximum returns from their assets: Regulatory changes and new tariffs and trade rules derail plans for supply chains and plants. Unpredictable global economics and pricing shift low-cost capabilities around the world. Emerging technologies and geographic market trends offer up new opportunities for growth as well as new competition.

In response to this demanding and fluid business environment, many PE firms are looking to optimize PortCos’ networks of plants, assets, and suppliers to increase value and returns. But this is no small task, and few PE firms or the companies they hold have the inhouse resources and experience to effectively take on these activities. Many are turning to EFESO, which has rapidly reconfigured sourcing and production networks, decreased network costs (from 20% to 40% in total landed cost savings), and increased profits from the same or fewer assets and investments. The EFESO Asset Portfolio Optimization approach includes:

- Value-Chain Optimization: Many companies’ collections of facilities and suppliers are not the result of a grand design scheme. They grew organically based on a need or opportunity, and often continue to exist as they always have because they always have. We go in and consider the holistic value-chain: quantifying all costs across all components and the many handoffs in between; identifying hidden wastes, areas of poor performance, and potential savings; and de-risking the value chain in the face of current and pending regional regulations. The result is an agile, resilient, and more efficient value chain able to swiftly capitalize on emerging value-creation opportunities.

- Network Footprint Optimization: The location of assets should rarely be considered fixed. As markets emerge and others subside, demand requirements for PortCos and their plants and production lines should change accordingly. EFESO helps PortCos by identifying and leveraging opportunities relative to market fluctuations and facility capabilities and capacities — determining where and how goods should be produced (make vs. buy). We establish and execute a clear, phased transition plan (moving lines, opening plants, closing facilities, etc.) that rapidly establishes a new, value-creating network that produces in the best locations in response to demand — today and tomorrow.

- Node Optimization: Even assets in the right locations and producing the right goods can be fraught with inefficiencies and wastes. We assess existing sites, benchmarking performances against best-in-class capabilities, and then — guided by our operational excellence subject matter experts (SMEs) — show and deliver results through the application of lean techniques. The improvements to quality, cost, and delivery dramatically impact a facility’s return on capital. We also establish sustainable operations that address current and future ESG requirements.

The EFESO Asset Portfolio Optimization approach is unique in that we not only work collaboratively with PE clients and PortCos to identify portfolio value-creation opportunities, but our SMEs are on the ground executing with them to make value creation happen — from ideation to sustainable P&L impact. This starts with strategy and proceeds through four demanding stages of execution.

Strategy and Footprint Design

Many consultants do this work, but few bring our industry expertise and on-the-ground experiences as we assess portfolios via on-site observations and deep data analysis of the current state. We identify what’s really possible. Our SMEs have opened, managed, and closed plants worldwide and, thus, estimate performance improvements and develop strategies and plans that we know are attainable and realistic. Our thorough analysis includes:

- Corporate goals and constraints (e.g., annual growth requirements, annual profitability requirements, capital expenditure limitations, management bandwidth cash flow analysis)

- Current capabilities and performances of sites, including potential product and process innovations that can substantially impact cost structures

- Current suppliers and their capabilities and performances

- Market growth opportunities and emerging risks

- Network designs for what to make and where (supported by the EFESO Footprint Calculator and Simulator) that evaluates all inputs (labor and material costs, customs, taxes, exchange rates).

Based on these findings, we propose make vs. buy scenarios; network configuration scenarios (product allocation, product flows from suppliers to plants to customers); and site configuration scenarios (layout/line changes, equipment, performance objectives) — and their resulting business cases (value-creation impact and timing). We also confirm that the commercial plan and changes have customer approval and adhere to their specifications and those in their industries.

Execution

The four stages for executing a network optimization strategy require hands-on attention in order to achieve the proposed strategic objectives. EFESO provides that via our “one-stop shop” approach, which is unique among firms supporting PE (see One-Stop Shop — Strategy & Execution):

- Plant/Asset Concept: Execution begins with the process of preparing for changes. We skillfully and efficiently manage this work — e.g., locating sites, designing buildings, managing contractors — because we’ve performed it dozens of times in a wide range of locations.

- Factory/Asset Planning: We establish the day-to-day details for new/revised sites and how they’ll operate. We use EFESO digital factory planning tools to simulate and trial layouts, and we apply our deep experience with lean thinking to establish best practices and standards for future facility processes.

- Realization Supervision: EFESO SMEs are on the ground, managing the transformation (e.g., construction, closings) and ensuring the myriad steps and parties will be able to hit superior time, cost, and budget targets.

- Ramp-up and Industrialization: The reconfigured network, plants, and lines come to life — on time and to budget. We put in place the management structures for success (roles, policies, workflows, key performance indicators); develop a capable workforce; and rapidly stabilize OEE to ensure consistent production efficiency, low variability, and achievement of operational goals out of the gate. We also establish a schedule of periodic reviews to identify future optimization opportunities.

EFESO Delivers

EFESO Delivers

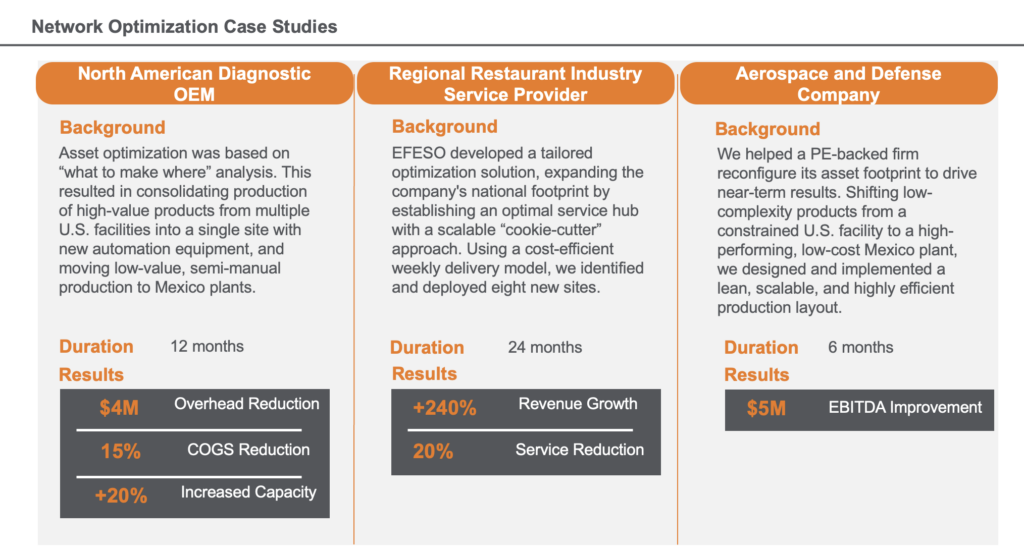

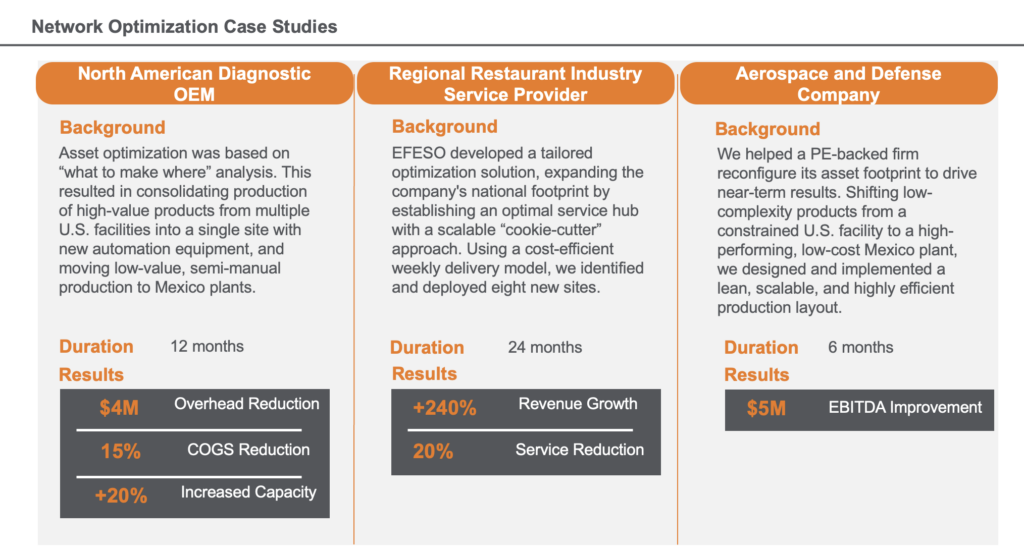

Asset portfolio optimization with EFESO rapidly delivers measurable impact, whether from a full end-to-end project or when PE firms seek assistance mid-stream (e.g., we get brought in to review a firm’s own strategic plans, manage the reconfiguration, and/or conduct on-the-ground execution of the plan). Timing to deliver tangible results can vary based on the extent of the portfolio reconfiguration (i.e., moving lines vs. building plants), but we’ve delivered significant return on assets in as few as six months for PE firms across industries and around the globe (see Network Optimization Case Studies).

We’ve also optimized the global operations footprint for a fast-moving consumer goods producer to reduce global operational expenses by 23% and inventory stock by 31%; established site selection and plant concept for an electronics company with 20% potential cost savings vs. existing facility; partnered with a lithium company to dramatically expand operations while bringing capital expenditures under control, reducing schedule deviations by 70% and reducing cost variations by 30%. Across the range of our projects, we have established a track record of value creation (see EFESO Asset Portfolio Optimization).

Optimize with EFESO

It’s not unusual for PE firms and large portfolio companies to identify significant value-creation opportunities through analysis of their networks. Yet many with plans to increase returns from footprints fail to do so because they’re left holding the execution bag, unable to actually make the time- and resource-intensive physical changes necessary for a more profitable network of assets.

We’ve worked with PE firms and industrial investors for more than 25 years, and we understand the need to increase value quickly. The EFESO Playbook for site consolidation, expansion, and relocation simplifies the complex execution of asset footprint alignments with optimization strategies. We also can tap 900 consultants around the globe with deep operations experience and a wide range of technical and industry expertise to tackle a PE firm’s specific challenges. And we have a proven track record with PE clients and PortCos of achieving agreed-to financial targets; our work is always focused on delivering real value creation with no excuses.

About the Authors

Fabian Rodriguez, Partner, Co-Leader Private Equity Practice North America, has over 20 years of global experience in value management, value strategy, and operations. Fabian is a trusted advisor and an expert in maximizing company value.

Alexandru Popovici, Global Lead Factory Planning and Managing Director for EFESO Central Eastern Europe, has over 20 years of experience in business consulting, operational footprint, site selection, factory planning, general planning, PMO, and realization support for new manufacturing sites.

Bruce Work, Partner North America, has over 30 years of experience in Supply Chain, Manufacturing, Maintenance, and Capital Expense Management. Bruce generates repeated value for PortCo clients through long term relationships and is considered a critical resource for numerous PE firms.

Iñigo Acha-Orbea, Strategic and Operational Consultant North America, has expertise in Asset Portfolio Optimization and Process & Operations Improvement. Iñigo is a skilled professional in driving sustainable value-driven transformations.