While the human tragedy and suffering continues, countries and economic zones are set to start an experiment with nature – countries around the world begin to reopen their societies and economies. We have never closed the world economy, much less restarted the global economy as COVID-19 continues. The pandemic locked down more that 50% of the world population. Reports indicate ¾ of German mid-sized companies (“Mittelstand”, companies from €1B-4B revenue) say that their supply chains have been disrupted in the last 8 weeks. In the United States, surveys from CNBC indicate that 1 out of 3 small and medium-sized businesses that shut down, do not expect to reopen. For the remaining, over half will not rehire the same amount of workers. Indicators point to at best a sharp recession, and if the decision-makers aren’t careful – a deep global depression. As the shockwaves of the pandemic reverberated around the world, companies’ reactions have universally been to focus on cash preservation. Now comes the difficult question, ‘What next?’

Our perspectives are based on countless conversations with our private equity network and from dialogue with our industry network across a variety of business segments. The predominant macroeconomic trend we see is that globalization will be reduced resulting in three major “economic blocks”: North America, Europe, and Asia / China. Although the trend toward localization started prior to the pandemic due to the trade wars and a renewed sense of local belonging, we see that the pandemic has drastically accelerated this activity with renewed urgency. A Bank of America survey of 3,800 businesses, coupled with the hundreds of ARGO-EFESO medical technology executives’ discussions cements the underlying and consistent theme of a shift from Asia; 37% of analysts with relevant coverage have officially seen, or are expecting, changes to supply chains through either reshoring or diversification.

Every company in every industry across the globe will need to reflect on three points as they rethink their supply chain in the context of this new normal:

- What will be sourced?

- How will it be sourced?

- What, where and how much will be held in inventory?

As companies embark on addressing these three fundamental questions, it is crucial to first recognize where value is defined and where value is generated. As shown in the figure to the left, although design (and here we refer to design of the products, design of the network and design of the internal value creation) only represents 5% of the total product costs, it defines most of the final costs. The design of the operational value cycles (product offerings, architecture, design, supply chain, manufacturing, and networks) are critical and should be conscientiously evaluated as economic zones are established post COVID-19.

What will be sourced?

The first aspect to consider when evaluating ‘What will be sourced’, is the appropriate level of vertical integration that will be required and be most effective for the business going forward. The automotive industry has spearheaded the reduction of vertical integration, shedding vast segments of their business, and today their business is mostly limited to marketing, design integration, and final assembly. As businesses have relied more on outsourcing, the shift has made companies far more dependent on their supply networks. However, different industries have relied on outsourcing to varying degrees driving a different level of vertical integration across industries. In general, as companies think about vertical integration, we find that they often think in mostly in binary terms: make or buy.

Our experience has shown that the process of vertical integration is far more complex as it falls within a continuum requiring analysis on 5 levels. In the new normal, every part (perhaps family of parts) should be evaluated along this 5-level continuum for each of the three emerging global economic blocks. Global companies may find the appropriate sourcing level will be different across the blocks. For example, we recently worked with an elevator manufacturer who deployed a ‘BTS’ strategy for the doors of their new elevators in Europe, while they pursued a ‘D&B’ strategy for their doors in China. This analysis and the resultant ‘plan-for-every-part’ is fundamental to make the right decisions for the future. As a part of the analysis, companies should establish internal processes capable to react very quickly as macro-events change given the dynamics of the post COVID-19 economy.

Our experience has shown that the process of vertical integration is far more complex as it falls within a continuum requiring analysis on 5 levels. In the new normal, every part (perhaps family of parts) should be evaluated along this 5-level continuum for each of the three emerging global economic blocks. Global companies may find the appropriate sourcing level will be different across the blocks. For example, we recently worked with an elevator manufacturer who deployed a ‘BTS’ strategy for the doors of their new elevators in Europe, while they pursued a ‘D&B’ strategy for their doors in China. This analysis and the resultant ‘plan-for-every-part’ is fundamental to make the right decisions for the future. As a part of the analysis, companies should establish internal processes capable to react very quickly as macro-events change given the dynamics of the post COVID-19 economy.

How will it be sourced?

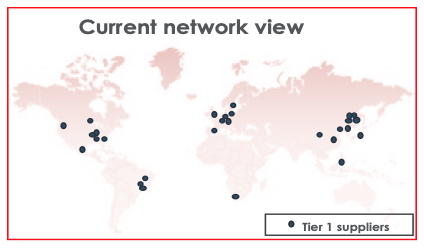

As companies shifted toward more outsourcing, they have also increasingly shifted towards single sourcing within the framework of a single global network. This was primarily driven through the necessity of concentrating volume of a given component or commodity to leverage negotiation power with the suppliers. In so doing, companies created a manufacturing capability comprised of their production facilities and network of tier-1 suppliers. This perspective was shattered as the shockwaves of COVID-19 broke. Suddenly seemingly robust supply chains were severed as suppliers could no longer fulfill their commitments. This scenario was not limited to tier-1 suppliers. Often it has been tier-2, tier-3, and beyond level suppliers who could not serve the customers as sophistication generally reduces further down the supply chain. We have found tier-2+ suppliers with poorly vetted supply chains, who often had multiple supply agreements far in excess of their capacity. With limited vision and auction block behavior by many suppliers’; OEMs were blind to their situation, not knowing where the supply chain was broken or being able to affect the failure point.

As companies shifted toward more outsourcing, they have also increasingly shifted towards single sourcing within the framework of a single global network. This was primarily driven through the necessity of concentrating volume of a given component or commodity to leverage negotiation power with the suppliers. In so doing, companies created a manufacturing capability comprised of their production facilities and network of tier-1 suppliers. This perspective was shattered as the shockwaves of COVID-19 broke. Suddenly seemingly robust supply chains were severed as suppliers could no longer fulfill their commitments. This scenario was not limited to tier-1 suppliers. Often it has been tier-2, tier-3, and beyond level suppliers who could not serve the customers as sophistication generally reduces further down the supply chain. We have found tier-2+ suppliers with poorly vetted supply chains, who often had multiple supply agreements far in excess of their capacity. With limited vision and auction block behavior by many suppliers’; OEMs were blind to their situation, not knowing where the supply chain was broken or being able to affect the failure point.

An example of this situation comes from a textile company that discovered even though they bought fabric from a Vietnamese supplier, they could not get fabric because the required die came from a factory in China. This underscores why a total network analysis, with a focus on risk, is critical to understanding the implications of any disruption on any level of the supply chain. Mapping the entire material flow all the way to the raw material suppliers is the appropriate level of diligence to properly understand risk of the supply chain. Once the material flow has been mapped, it is possible to assess and monitor the material flow, financial viability, local conditions, etc. and establish appropriate mitigation strategies.

An example of this situation comes from a textile company that discovered even though they bought fabric from a Vietnamese supplier, they could not get fabric because the required die came from a factory in China. This underscores why a total network analysis, with a focus on risk, is critical to understanding the implications of any disruption on any level of the supply chain. Mapping the entire material flow all the way to the raw material suppliers is the appropriate level of diligence to properly understand risk of the supply chain. Once the material flow has been mapped, it is possible to assess and monitor the material flow, financial viability, local conditions, etc. and establish appropriate mitigation strategies.

As situations can change quickly, companies must establish protocols to monitor and address changing conditions in real-time. Fortunately, advanced analytics tools exist to enable the necessary level of scrutiny.

Scenario Planning

Once companies have mapped and understand their global supply network, they must stress-test their risk mitigation strategies. This is accomplished through leadership war game scenarios used to simulate various conditions. These ‘what-if’ scenarios should represent various issues which could occur within the network. The results are then evaluated against critical predetermined decision criteria and target operational performance metrics. In order to be effective, the process must start by understanding the basis for making supply chain decisions where lead-time to market, raw material supply, compliance with regulations, total cost of ownership, political (in)stability, health risk, and financial health of the supply chain are potential vectors to be considered. This exercise provides leaders insight to their business in ways traditional reports cannot and prompts companies’ leaders to make profound changes to their supply chains.s’ leaders to make profound changes to their supply chains.

Once companies have mapped and understand their global supply network, they must stress-test their risk mitigation strategies. This is accomplished through leadership war game scenarios used to simulate various conditions. These ‘what-if’ scenarios should represent various issues which could occur within the network. The results are then evaluated against critical predetermined decision criteria and target operational performance metrics. In order to be effective, the process must start by understanding the basis for making supply chain decisions where lead-time to market, raw material supply, compliance with regulations, total cost of ownership, political (in)stability, health risk, and financial health of the supply chain are potential vectors to be considered. This exercise provides leaders insight to their business in ways traditional reports cannot and prompts companies’ leaders to make profound changes to their supply chains.s’ leaders to make profound changes to their supply chains.

The post COVID-19 environment clearly points to a number of trends companies must consider as they embark on the process to reassess their supply networks and product architecture:

- Significant amounts of manufacturing will leave China and be distributed in the 3 global economic blocks. As localization occurs, COGS are anticipated to increase (approximately 15%), supply chains will grow shorter. Companies will need to perform a structured and repeatable balancing act to make decisions.

- Manufacturing will be simplified in terms of the SKUs that will be offered to the localized marketplaces. Engineering, purchasing, supply chain, quality and other functions need to reinforce their global strength while simultaneously building regional capabilities to support the more localized supply network. This will necessitate SKU’s to fulfill multiple applications or to be subcomponents in multiple solutions.

- Single sourcing will be reduced to allow global economic regions to be self-sufficient and to enable alternative supply paths within the network. The balance must be struck in the distribution of purchasing volumes to suppliers in order to retain as much purchasing power as possible.

- Supply chains will become more efficient and shorter within each economic block; however, they will grow longer and more expensive across the 3 zones. Comprehensive re-negotiations with packaging and transportation vendors will be more frequent.

- Quality systems and product development capabilities will be severely tested as new supply streams are created, resources stretched, and expertise shifted. Some suppliers ramp down while others ramp up, and capabilities are duplicated.

- Companies will increase M&A activity looking for solutions to gaps found in their assortment, supply chain, or geographic demand. Other companies will be looking for distressed assets to faster fuel growth and efficiency.

- Collaboration between the supply chain players is going to be simplified, automated, and universal to provide global views of inventory and demand. Institutions will need to learn how to “buy sideways” from other players as critical demand dictates. Technologies like logistics blockchains will become the new norm to increase supply network transparency.

How to address these challenges?

Some of the processes described below may already be part of the protocol of your company. If not, the following section lays out processes for your consideration. If these processes are already in your organization, make sure to build the muscle and discipline necessary to very quickly and flexibly execute the overall workflow:

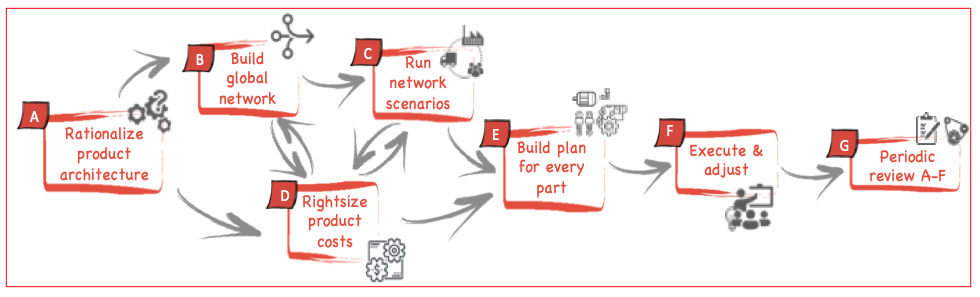

Our perspective is that the product planning and the global network / supply chain vectors of an organization need to work together much more harmoniously than in the past, involving the financial teams in every step to ensure correct decision-making. The 7 steps described provide an overview of a process for addressing many of the supply chain challenges COVID-19 has created in the Medial Technology segment. (Please note this is an overview and not an exhaustive list). This intersection of global strength and local capability where companies will suffer or thrive.

- Visualize current architecture within each economic block and globally

- Segment product offerings to secure demand: products that enable/destroy value, strategic products.

- Align scarce resources to highest value generating SKUs, align incentives for those SKUs

- Decide on product strategy for every application / market segment, including service and aftermarket

- Understand the complete supply network at the tier 1, 2, 3, 3+ level in each economic block and globally (including raw materials

- Assess financial health and physical supply locations for each level

- Develop a clear understanding of the ownership structures of suppliers and key raw materials providers to avoid building unknown risk

- As appropriate, define alternative suppliers for complete vetting and sampling

- Define and later execute M&A where value can be created through capacity, costs , service, speed

- Run “War game” scenario modeling under different conditions. Decide on multiple sourcing and other strategies as required

- Secure transportation modes for alternative scenarios

- Develop long-term SIOP based inventory and production scenarios

- Balance risk mitigation with financial consequences (based on total cost of ownership)

- Understand how adjacent industries will influence your network as they diversify, re-locate, etc.

- Perform value engineering projects (VA/VE), which include component standardization, customer application coverage, modularization, etc. to offset supply changes. Involve cross-functional teams from different regions, and allow strong input to interpret local requirements by local specialists

- Ensure inflow of “6 idea sources”: function analysis, sourcing, supplier input, performance teardown, benchmarking, design-for-manufacturing / design-for-assembly (DfM / DfA)

- Actively involve suppliers locally and globally

- Align product cost reduction opportunities with potential material cost increases from multiple sourcing options

- Evaluate along the 5-level continuum of vertical integration to make relevant make/buy decisions. Integrate decisions into network plan

- Prioritize high-value / unique raw materials and parts

- Align vertical integration with financial returns

- Build contingency plans for different vertical integration levels per geography, supplier, part family, part, etc.

- Where applicable, plan for in-house production and footprint consequences

- Include pricing policies into the plan for every part (PFEP)

- Visualize the complexity of all changes on various consolidation levels

- Develop process and mechanisms for all supply chain partners to provide updates

- Develop full transparency of transactions by the various supply levels from order acknowledgment to delivery to warehouse or customer. Use newest technologies if appropriate, f.e. logistics blockchains

- Create / amend the master service agreements (MSA) with all suppliers to include the periodic supply chain reviews into their scope

- Build “command centers” into the execution strategy

- Educate, build, and drive accountability of actions

- Establish a steering team and a assemble a working team to review and drive improvement loops back into the steps

- Re-visit the process periodically for new / other parts & products

- Standardize and adjust process flow

- Periodic (f.e. bi-annual) review of network design to react to new supply and demand

No one knows for sure how this pandemic will transpire to conclusion. Opinions abound as to how the global economy will recover – whether the recovery will be a “V”-shape, “U”-shape, “W”-shape, etc., we do not know. We do know that eventually the world will recover, it is a question of when and how. We do know for certain there will be winners and losers from this crisis. One of the key determinants as to which side we land on is how well we address and mitigate the risk of the supply network given our new reality.

About the Authors:

Tony Donofrio, Senior Vice President & Partner, is ARGO-EFESO’s Supply Chain Practice Leader. He has over 30 years experience in Retail, Consumer Products/Packaged goods, Pharmaceutical, and Manufacturing industries. [email protected]

Dantar Oosterwal, Senior Vice President & Partner, is ARGO-EFESO’s Lean Innovation & Product Development Practice Leader. He is highly regarded as a global thought-leader in Lean Innovation & Product Development systems. [email protected]

Andreas Dörken, Senior Vice President & Partner, is ARGO-EFESO’s Head of Operations Europe and Co-Head of the Product Innovation & Value Management practice. He has over 25 years of experience working in industrial firms and consulting. [email protected]

Bruce Work, Vice President ARGO-EFESO’s Supply Chain Practice. He has over 25 years experience in Consumer Products/Packaged goods, Retail, Distribution, Pharmaceutical, and Manufacturing industries. [email protected]